Most of the time I feel like Schrodinger’s Freelancer: I’m both doing pretty well and one step away from bankruptcy. Any time I’m working, I’m fine. Any time I’m not, I can’t relax because what if I never manage to get any work again?

This was fine in 2016, but as the new year arrives, I’m making some changes. I am going to eliminate some of the parts of my freelancing career that give me unnecessary uncertainty.

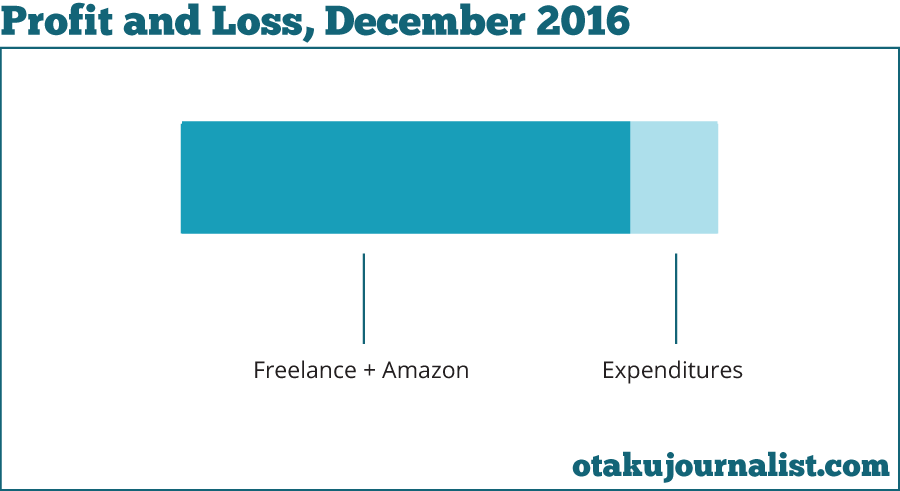

The first thing I did was spend some money. This doesn’t look like much, but I spent almost $700 on business expenses in December. It started on the 23rd when ALL my websites went down! I then spent the rest of the holiday trying to figure out why. I spent three hours on Boxing Day on the phone with Bluehost (note: this is my affiliate link!) trying every possible fix, from disabling every plugin and non-basic theme, to updating the PHP version, to refreshing the WordPress core files.

Troubleshooting with Bluehost wasn’t my first choice for how to spend the holidays, but the longer I stayed on the phone, the more I realized why I’ve been a Bluehost web hosting customer for seven years. More than anything else, I appreciate their tech support. There’s hardly ever a hold time, there’s no song and dance with a robot, and the technicians treat me like a person and acknowledge that I know my own sites best. So when we finally reached the conclusion that I needed to upgrade my Shared Hosting plan ($6 a month) to my own Virtual Private Server ($18 a month), I realized that I was actually comfortable investing this much money now. And sure enough, this was the fix I needed—I had exceeded my traffic and memory limits for shared hosting, and that was the issue.

My next expense was MUCH cheaper—Quickbooks Self Employed is having a sale right now, and it’s only $5 a month for the first six months. I’d been on the fence for a long time, but after reading Nicole Dieker’s review on The Billfold, I finally took the plunge.

Since 2013, I have tracked my business income, expenses, and estimated taxes in a Google Spreadsheet. It’s free, and I figured it was all an organized person like me needed. But Quickbooks is already eliminating the double-checking I have to do for stupid financial mistakes. With my spreadsheet, I have to deposit a paycheck, check for it to appear in my bank account, and then correctly write down the amount and date it arrived. It takes a lot of mental energy because if I accidentally wrote $450 and the check was for $475, I’d be unwittingly committing tax fraud. This is why the IRS audits self-employed people more than anyone else.

Quickbooks syncs with my bank account (it’s an Intuit product so if you have Mint, well, it works exactly like Mint) so I don’t have to worry about getting my accounting wrong. When the paycheck arrives, I mark it as business income, attach a PDF of my invoice, and I’m done. The best part is that it calculates my quarterly estimated taxes, so I can do less math. I usually spend the year wondering if I paid too much or too little in taxes, but I won’t in 2017.

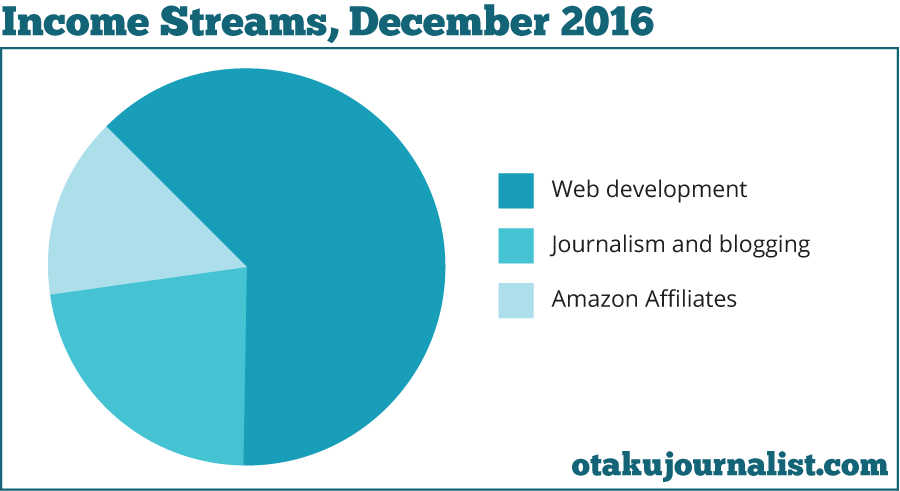

This month has also been momentous when it comes to income streams. Notice I changed the legend. Now that I quit my day job, I divided my “freelance” income (formerly medium blue) into two parts—my web work and my writing work. It looks like web work is still my biggest income slice right now, even if I am back to working on projects for clients.

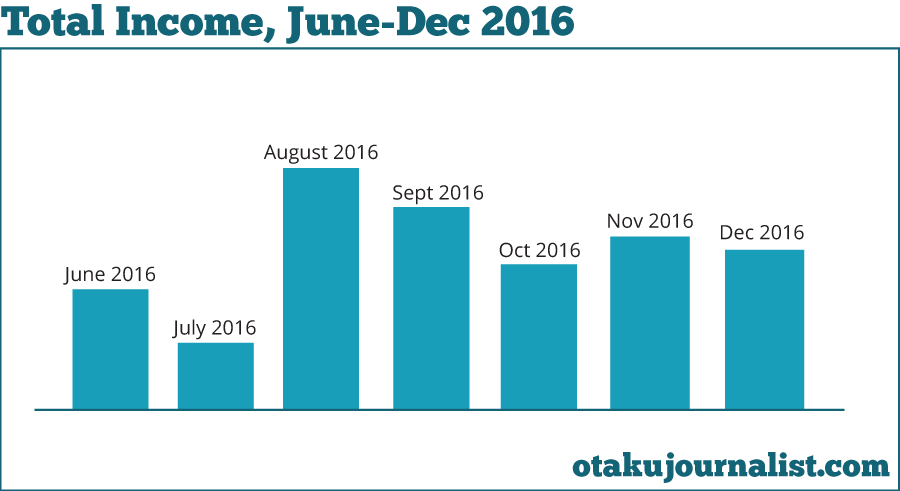

I’ve mentioned before that the Amazon Affiliate program pays me on a three month delay, so the paycheck that made this pie chart, around $500, was was I earned in October. In December, I finally met a goal I’ve had for a long time—I made $1000+ in one month. I didn’t know if I’d meet it, since my sites were mostly down from the 23-26 and I made about $2 that entire time! Now, my goal is to make four figures every month in 2017. If you want to start, too, here’s my free guide.

I worked really hard this December, compared to usual. I worked on my birthday and Christmas, which are usually days I’d rather take off. Ideally, this means that January should be pretty comfortable, but like I said, it’s little comfort to Schrodinger’s Freelancer, who needs to work on adjusting to living without a safety net, AKA a salaried job.

How did I do on my December financial goals? I finished launching my “business venture,” which I revealed to be my Asuna WordPress theme and my new freelance web design business. I bought gifts for everyone for around $400 which felt like a lot, but family and friends are worth it. I did not even TOUCH Gunpla DB, oops.

My January financial goals are:

- Master Quickbooks and start making it work for me.

- Pay estimated taxes and mail out my 1099-MISC forms to my subcontractors ahead of schedule!

- Forget about work for just a few days. I’m taking a small vacation with some friends in late January, and I’m going to do my best not to touch my laptop during that time.

Happy 2017! What are your financial goals?

Previously: